Effect of Russia’s Invasion of Ukraine on India’s Climate Policy and Practices

By Pooran Chandra Pandey

Russia’s continuing war on Ukraine has begun to show its ripple effects on India’s fuel and energy markets, with global crude oil prices shooting past the $100 (Rs 7,527) a barrel (159 liters) accentuating the oil crisis in the country— the highest recorded since 2014. As the situation escalates between the two warring countries, the oil rates are bound to go up further casting a shadow of inflationary pressures across the board, making life difficult for the millions, especially when global crude oil prices had already been elevated since the middle of 2021 and have since been rising continuously thereon. The crisis has been piling even more pressure on the already stressed global energy supplies and low storage levels around the world.

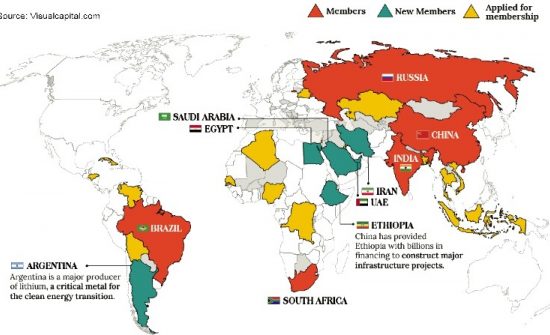

Even though, India imports only under two percent of its crude oil from Russia, making it less vulnerable to supply disruptions. However, the country is susceptible to the global price rises, and India like other nations would find it difficult to be able to avert the impending oil crisis due to the ongoing Russian war, given the oil price volatility in the international markets with Russia controlling a large part of coal, oil and gas import to EU, exercising its control both on oil reserves and pricing mechanisms through its membership of OPEC+ (oil-producing countries) grouping.

Furthermore, the United States and its allies have imposed sanctions on Russia after it began the military assault on Ukraine and the ongoing situation is only likely to further escalate the global supply of crude oil, pushing the prices up. If the conflict continues to escalate with Russia retaliating against the US and European sanctions by reducing or suspending oil exports, the oil prices could escalate even further very quickly.

Within India, industries are likely to take the biggest hit with consumer demand further suffering, which may have a medium to long term impact on India’s economy and its development, in the aftermath of having faced depressing economic and industrial activities in the recent past due to Covid-19.

India is a deregulated market now where oil prices are determined based on what happens globally and are largely driven by demand-supply scenarios. Public sector Oil Marketing Companies (OMCs) thus revise the retail prices of petrol and diesel in India according to changes in the international energy markets. Other factors that play a role include exchange rate, tax structure, inland freight, and any further additional costs. Dealers also play a part, making up 42 percent of the retail price in the case of petrol and 49 percent of the retail price in the case of diesel, as of October 16, 2021.

Another important factor determining oil prices is taxes levied by the Centre and sub-regional governments. The Centre taxes Rs 32.9 per liter on petrol and Rs 31.8 per liter on diesel, constituting 31 percent and 34 percent of the current retail prices of petrol and diesel, respectively. The value-added tax imposed by the sub-regional governments also determines the rates. Delhi, for instance, charges 19.40 percent and 17 percent on petrol and diesel while the sub-region of Rajasthan’s share is 31.04 percent and 19.30 percent, respectively.

In such a scenario, lowering tax rates is the only way the government can keep high crude oil prices from trickling down to the end consumer. When such a reduction is undertaken, planned expenditure set earlier by the central government is disrupted and there are fewer financial resources available for purposes of development initiatives. One thing that’s certain is that the Indian energy bill due to Russia’s war on Ukraine has gone up for no fault of its own. This situation, further, throws light on India’s energy security problem with the country importing over 85 percent of its oil needs, with Saudi Arabia and the United States being its biggest suppliers. The United States has put Iran under sanctions, following which India stopped buying oil from the latter in 2019. Saudi Arabia could potentially use the conflict to increase oil rates. The country bases its expenditure budget on oil being around $80.

In the hindsight, there may potentially be good news. The ongoing conflict could however benefit the clean energy market as India has already started channelizing its investments into electric vehicles and green hydrogen segments, which are substitutes for oil and gas, much like what the EU block and the US have already started taking steps in the said direction in securing energy security. This transition may, however, take a medium-term horizon to fructify but this crisis may help nations realize the need to invest in green and clean energy while staving off their dependence on Russia’s coal, natural gas, and oil, especially in the EU.

India and Russia have long been friends through the country’s overdependence on defense deals and oil imports, and such a bilateral relationship between the two shall expectedly play out. Russia has already offered India oil at a deep discount and the country has accepted to import more than 3 million barrels which would in part save foreign reserves for India with transactions taking place in local currencies. India has politely declined entreaties by US and Australia stating that the alternatives offered are very expensive.

The transport sector in India consumes over half of India’s oil products, and in particular, diesel which is 35-40 percent of the total, is still susceptible to such price shocks in the global oil market. It is estimated that the Indian economy due to the ongoing Russian war with Ukraine is likely to make the matters worse, including building inflationary pressures within the economy with obvious price rises across the food, transport, and every other sector that depends on the use of oil.

The ongoing Russian war on Ukraine and disrupted energy security situation in India may potentially impact the country’s ongoing climate policies and practices including the climate commitments the country made at recently concluded COP 26 in Glasgow in more ways than one. India would, under the prevailing situation, like to find alternatives to be able to continue to advance its economic activities and industrial production, and may have a propensity to fall back on coal ( fossil fuels) in the interim, taking the cover under COP 26’s official Climate Communiqué that states the coal can be ‘phased down’ than ‘phased out. The world has to be conscious of the fact that conflicts and wars would easily derail the other serious commitments that they have since made out of the gear, making the world more seriously about the consequences of climate change, with the recently released Intergovernmental Panel on Climate Change (IPCC) report predicting the dire consequences of the climate change for the humanity in case appropriate steps are not taken in time by signatories to the Paris Climate Agreement (2015).

Wars and conflicts thus serve no purpose whatsoever for any nation and their people and should therefore be abstained from at all costs. Moreover, the world is deeply connected through commodities, energy prices, development cooperation, and supply chains. One conflict in one part of the world is bound to impact other parts as well. Russia’s war on Ukraine thus is economically catastrophic for the world at large beyond the limited political purposes and gains it may potentially serve for some.